FHA-approved lenders received the go-ahead to develop bridge-loan products that enable first-time buyers to use the benefits of the federal tax credit upfront, according to eagerly awaited guidance from the U.S. Department of Housing and Urban Development on so-called home buyer tax credit loans that was released today.

NEWS FLASH: Buyers May Get Loans to Use $8K Tax Credit Toward Closing Costs

Fri, May 29th 2009 4:45 pm by Alan Donald BuyersWho Works For Whom?

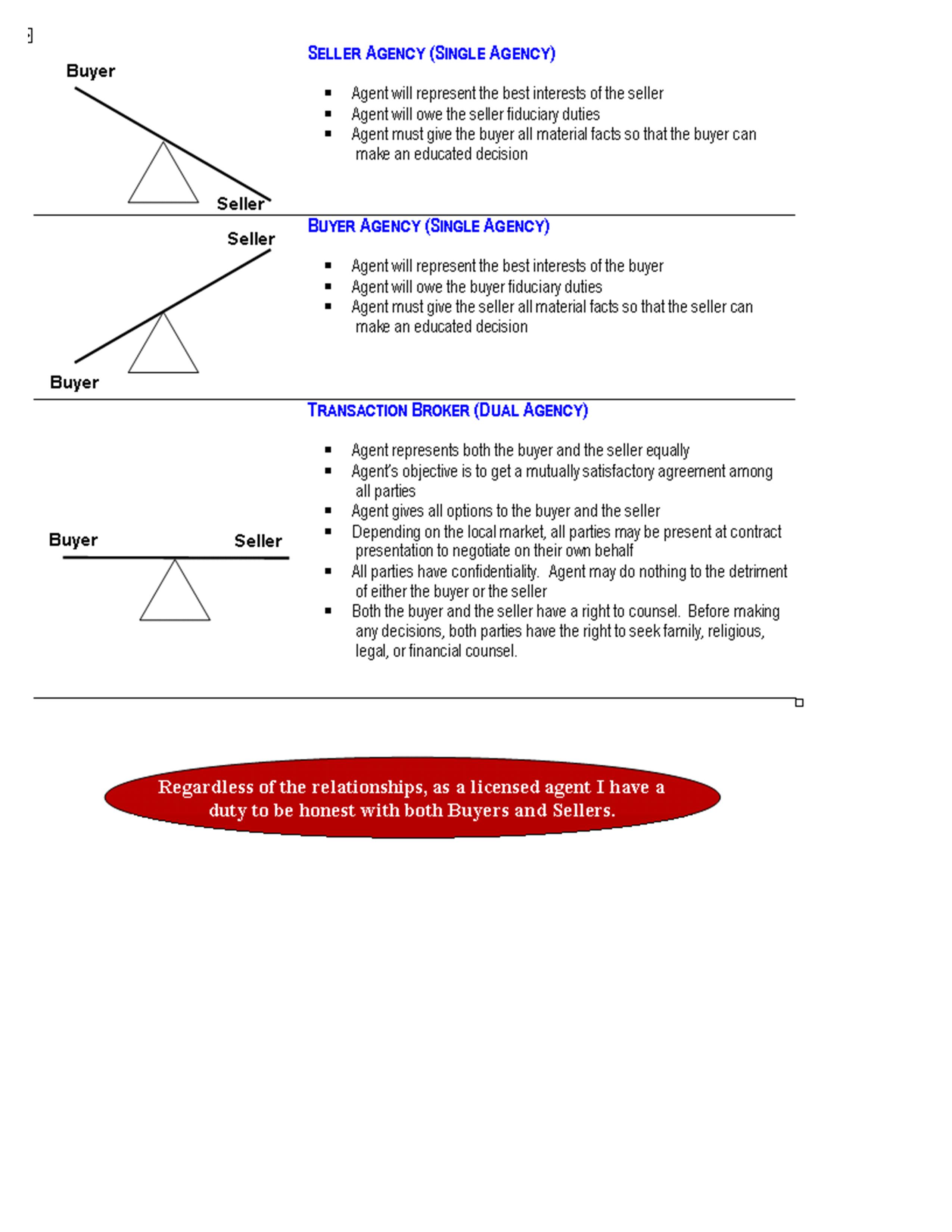

Fri, May 29th 2009 4:00 pm by Alan Donald Real EstateIn South Carolina, state law maintains that the REALTOR must represent at least one of the parties in the transaction (cannot be neutral). Consumers have the option to hire an agent (become a CLIENT with fiduciary responsibility from the agent) or remain a CUSTOMER (at arm's length) and represent him/herself in the transaction.

The LISTING AGENT always represents the seller. Sometimes a buyer will purchase a home with the help of the listing agent. In this case, known as DUAL agency, the agent assists both the buyer and the seller in the transaction. However, it is also possible that the buyers want an agent representing their interests exclusively (BUYER'S AGENT) , a service which ...

Mortgage Rates on the Way Up?

Thu, May 28th 2009 5:56 pm by Alan Donald Mortgages Yesterday mortgage bonds had their worst performance since last October, and as a consequence rates climbed about a half of one percent! It appears that the Treasury has been issuing bonds (i.e. like printing money) to fund all these massive rescue programs, and yesterday supply of bonds exceeded demand and prices for whole bond market fell, causing interest rates to climb to try to attract buyers.

Yesterday mortgage bonds had their worst performance since last October, and as a consequence rates climbed about a half of one percent! It appears that the Treasury has been issuing bonds (i.e. like printing money) to fund all these massive rescue programs, and yesterday supply of bonds exceeded demand and prices for whole bond market fell, causing interest rates to climb to try to attract buyers.

If the bond market does not bounce back through the several levels of resistance that it went down through, mortgage rates are going to stay higher for a while. It seems that those buyers and investors that were waiting for the 4% mortgage rates are going to have to make a tough decision.

It...

Extra Costs When Buying a Home

Wed, May 27th 2009 4:00 pm by Alan Donald Buyers Extra Costs When Buying a Home

Extra Costs When Buying a Home

When you are buying a new home, there are many costs on top of the purchase price that you need to be aware of, because they may factor into your future affordability, and your ability to close the transaction. Some of these expenses are one-time charges, others are monthly or annual fees.

Here is a list of some of these costs:

Property Taxes - paid in arrears (at the end of the year) and prorated as of the date of closing. Your lender will normally collect monthly 1/12 of the estimated annual property tax, place it in your escrow account, and pay the taxes for you at the end of the year. The closing attorney will collect some prepaid taxes at closing to...

Homes on Busy Streets

Tue, May 26th 2009 9:45 am by Alan Donald Buyers Every day when you drive to work you see a beautiful home with a "For Sale" sign on a busy road. Given the size and quality of the home, you think it must be priced well above your price range. After months of curiosity, you call for information and you find out it is surprisingly affordable, priced much lower than similar homes on quiet streets! You schedule a showing, and you love the home...

Every day when you drive to work you see a beautiful home with a "For Sale" sign on a busy road. Given the size and quality of the home, you think it must be priced well above your price range. After months of curiosity, you call for information and you find out it is surprisingly affordable, priced much lower than similar homes on quiet streets! You schedule a showing, and you love the home...

Homes located on busy streets may represent great value for the money. Some buyers who are very sensitive to noise, have young children or pets, may automatically rule out homes on busy streets. If the sellers have made pricing concessions to reflect the location of the home and you are not bother...

Mount Pleasant Farmer's Market

Mon, May 25th 2009 2:15 pm by Alan Donald General

Last week the new and improved Mount Pleasant Farmer's market was re-launched, as part of the Coleman Boulevard Revitalization project. The Farmer's Market meets every Tuesday afternoon next to the (also brand new) Moultrie Middle School and offers local vendor's produce, crafts and services, as well as entertainment for all family members. Here is a link to the ABC News story:

The "Dry" Closing

Sun, May 24th 2009 12:15 pm by Alan Donald Real Estate Buyers and sellers have agreed to terms and conditions, the buyers have done their inspections, repairs have been agreed and done by the seller, the attorney has done the title work, the appraisal has been done, everything seems going perfect to close on time...

Buyers and sellers have agreed to terms and conditions, the buyers have done their inspections, repairs have been agreed and done by the seller, the attorney has done the title work, the appraisal has been done, everything seems going perfect to close on time...

Enter, the lender's UNDERWRITER.

During the housing boom that ended three years ago, underwriters were just an extra check, and they were not really very concerned about confirming every little detail on the loan application, the contract and the origin of the deposit money. Maybe that's one of the reasons why we are in this mess altogether!

This has changed! Today underwriters have (it seems) unlimited power to minutiously dis...

Need Money?

Sat, May 23rd 2009 12:00 pm by Alan Donald Buyers Before you start shopping for a home, it is essential to get pre-approved by a lender. This does not mean that you cannot keep "shopping around" for the best loan while you look at homes. Once you have a signed (or "ratified") contract, you will need to choose a lender, submit a formal application and many times pay a fee (usually the cost of the appraisal) to the lender.

Before you start shopping for a home, it is essential to get pre-approved by a lender. This does not mean that you cannot keep "shopping around" for the best loan while you look at homes. Once you have a signed (or "ratified") contract, you will need to choose a lender, submit a formal application and many times pay a fee (usually the cost of the appraisal) to the lender.

So, how do you choose the right lender?

It is important to choose a reputable lender, but also one that has the right loan program to fit your particular situation. It is important to carefully compare rates, origination and processing fees, terms, conditions and restrictions before making a final decision.

Some lend...

Buy or Sell First?

Fri, May 22nd 2009 11:35 am by Alan Donald General Many people are looking at real estate prices and thinking it's a great time to buy. And they are right. The problem is - they may need to sell their home first to complete their downpayment, and in a buyer's market, this sometimes can be a challenge.

Many people are looking at real estate prices and thinking it's a great time to buy. And they are right. The problem is - they may need to sell their home first to complete their downpayment, and in a buyer's market, this sometimes can be a challenge.

It is important that you sit down with your REALTOR® and explore all the options available to you. Here are some of them:

- Buy first, sell later. Advantages: You can take advantage of current buying opportunities and low interest rates. Disadvantages: You may not qualify for both loans, and if you do, you may have to pay two mortgages until your old home sells. You may also explore the availability of a "bridge" loan from your lender to h...

Spoleto Art Festival Starting!!

Thu, May 21st 2009 12:14 pm by Alan Donald General Spoleto USA, the 2-week festival that makes Charleston a bright spot with music, art, theater and dance performances and exhibits is opening tomorrow, May 22nd!

Spoleto USA, the 2-week festival that makes Charleston a bright spot with music, art, theater and dance performances and exhibits is opening tomorrow, May 22nd!

The opening weekend include a performance of the opera Louise at the Gaillard Municipal Auditorium; the Don Juan tale Don John, at the Memminger Auditorium;and an Alvin Ailey American Dance Theater performance. Check out all the events here.

This year the festival features one of my favorite dance troupes, the Alvin Ailey American Dance Theater...

The Perfect "Storm" for Buyers

Tue, May 19th 2009 1:45 pm by Alan Donald BuyersTHE PERFECT STORM FOR BUYERS

The sub-prime mortgage troubles of 2006-2008 has left the mortgage industry limping - causing the failure of a number of well-known banks.

The Federal Government stepped in early September, 2008 to rescue Fannie Mae and Freddy Mac, the two giant, quasi-governmental companies that buy the bulk of the mortgage loans from commercial banks and were experiencing difficulties. This "rescue" signalled the intention of the government to shore up the mortgage industry and help the housing market lead the economy out of the doldrums.

With the economy stalling, the Federal Government has stepped in to provide a stimulus to help the housing market. A combination of fac...

The Ups and Downs of the Real Estate Market

Sat, May 16th 2009 1:45 pm by Alan Donald Real EstateTHE UPS AND DOWNS OF THE REAL ESTATE MARKET

So, you noticed that three years ago, your next door neighbors put their house on the market one morning, and by that afternoon they had multiple offers to choose from. Now you have been trying to sell your home for six months and there's just no action...!

The real estate market is unpredictable in the short term, since many factors (like interest rates, the amount of new homes being built and the economic health of the area) come into play. In the long term, the real estate market behaves just like other economic markets. It is a cyclical market (and in many places also seasonal). And it is driven by underlying supply and demand.

In a strong sell...

Good News! Mt. Pleasant Housing is Now More Affordable!

Sat, May 16th 2009 9:15 am by Alan Donald Mt Pleasant Real Estate MarketFor the first time since 2002, the Personal Income line and Median Sales Price line will intersect again this year, showing the effect that the softening of the real estate prices in Mt. Pleasant has had on home affordability: The green line shows the average percentage of household income that a household spends on housing - we are back to the level of affordability we had at the beginning of the century! This is good news for first-home buyers and for families who need to upsize their home! Peak inventory in Mt Pleasant happened back in July 2007, and, given that demand has decreased noticeably, housing is forecasted to remain affordable for a while - we still have a large inventory to ...

What Would Your Future Mother-In-Law Think?

Wed, May 13th 2009 3:30 pm by Alan Donald Sellers You can bet on it - the KITCHEN is one of the key areas of a home that most buyers will look at to short-list their preferred homes from a long list of available listings.

You can bet on it - the KITCHEN is one of the key areas of a home that most buyers will look at to short-list their preferred homes from a long list of available listings.

A smart seller will devote time, attention and money to make the kitchen sparkle! Although many buyers want an updated kitchen (solid surface countertops, modern cabinets, stainless steel appliances, etc.), your kitchen does not have to be state-of-the art to be appealing.

Think first impressions: What would you do to impress your future mother-in-law if she was coming to visit you for the first time?

The first step towards enhancing the appeal of your kitchen is giving it a thorough cleaning and tidying up. Make s...

Making "Clean" Offers

Wed, May 13th 2009 1:45 pm by Alan Donald BuyersMAKING "CLEAN" OFFERS

You are in the market to buy a home and you found a house that's ideal for you - it is in the right location and meets all your "needs" and "wants". The price is the only thing that is keeping you from making an offer, because you feel that it is more than you can afford... how can you improve the odds of the Seller accepting your offer (that is much lower than their asking price)?

In addition to a market justification for a low offer (which your REALTOR can provide) an important strategy you should use is to make your offer as "clean" as possible by not asking for special conditions or contingencies.

- Avoid making demands on the sellers for minor repairs, such as ...

Be Proactive - Deal With the Defects Upfront

Mon, May 11th 2009 1:00 pm by Alan Donald Home MarketingEven if you are selling your home "as-is" (which means you are not willing to pay for any necessary repairs), most buyers will include an inspection contingency clause in their offer. This will allow them to hire any number of experts (including a home inspector, a termite inspector and a structural engineer) to make sure that the house is safe, structurally sound and all the systems are working properly (i.e. that they are not buying a "lemon"). The inspection contingency allows them to walk away from the deal without losing their earnest money if they are not satisfied with the condition of the property.

You, like most owners, will probably know most of the issues that need attention a...

Use Your Tax Refund to Improve Your Credit Score

Sun, May 10th 2009 9:15 am by Alan Donald Personal Finance

I recently read an article in the Post & Courier that had some interesting suggestions about how to use your tax refund this year to improve your credit score. These are the highlights:

- Set aside only a small percentage (i.e. 10%) of the refund as "spending" money.

- Set up an emergency fund - just in case you or your spouse are laid off. They recommend having 6 months to 12 months household expenses in this fund. You can put up to $5,000 a year ($6,000 is you are 50 or older) into a Roth IRA and invest it in a CD or money market mutual fund so that it is not vulnerable to stock market variations. And you can use this money for college, retirement or emergency without paying penalties...

Curb Appeal - First Impressions Count!

Sat, May 9th 2009 1:00 pm by Alan Donald Home Marketing

We make thousands of small and big decisions every day. Our senses (eyesight, smell, feeling, hearing) are constantly telling us a story about our surroundings. When we are looking to buy a home, those INITIAL impressions from the first few seconds after we stop in front of a home may make a positive or negative emotional impression that may outlast later impressions (remember that "an image is worth a thousand words").

This initial impression makes a statement about your home and yourself as the owner. Whether your home is contemporary or traditional, older or newer, its architectural features and curb appeal will impact potential buyers. Your home has its own unique features and personal...

The Condition of Foreclosed Homes

Fri, May 8th 2009 5:15 pm by Alan Donald Market OpportunitiesI use several "preferred" home inspectors regularly, because they have shown professionalism, subject knowledge, thoroughness and reliability.

Housemasters is one of those, they send me a regular newsletter with topics of interest. Their latest newsletter talked about the top 5 conditions that inspectors find in foreclosed homes, which I thought would be interesting to share. Here is a summary:

- Mold - many foreclosed homes have the power disconnected or may have developed ongoing leaks that coupled with a boarded up or abandoned home creates the appropriate moisture conditions for mold to grow unabated, especially in the Lowcountry, where humidity levels are high. Black mold can creat...

Buy New, or Existing?

Thu, May 7th 2009 12:45 pm by Alan Donald BuyersBUY NEW, OR EXISTING?

One of the big decisions that a buyer must make, is whether to buy a new home, or an existing one. While new homes tend to have higher prices than comparable existing ones, there are other factors to consider:

TIMING - new tract homes can take 4-6 months to build (up to 12 months for custom-built). If you need a home sooner than this, you may look at inventory homes (or "specs") that new home builders may have available or in advanced construction, or existing homes.

PRICING - while new homes are generally more expensive, when a market is over-supplied, new home builders tend to offer larger incentives for buyers than those an existing home owner may be able to give. In...